October 8, 2020

Orogen options the Baby Doe gold project to Premier Gold

Vancouver, B.C. October 08,2020 (TSX-V: OGN) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that it has optioned the Baby Doe gold property in Esmeralda County, Nevada to Au-Reka Gold Corporation, a subsidiary of Premier Gold Mines U.S.A. (“Premier”). Premier can earn up to a 100% interest in the Baby Doe gold project by making cash payments totaling US$1.0 million and spending US$10 million in exploration expenditures over an eight-year period. Once Premier has obtained a 100%interest, Orogen will retain a 3% net smelter return royalty (“NSR”) on the Baby Doe claims and a 1% NSR on the Mustang claims.

“Orogen holds a portfolio of precious and base metal exploration projects generated from it’s exploration pipeline that allows for organic royalty creation. It is the backbone of our business and provides our shareholders multiple opportunities for wealth creation,” commented Orogen CEO Paddy Nicol. “We are very pleased to have Premier Gold as a partner to advance exploration on our Baby Doe project.”

Premier can earn an initial 55% interest (the “Initial Interest”) from Orogen over a four-year period by making cash payments of US$200,000to Orogen and completing US$5.0 million in exploration expenditures. Premier will also assume cash payment obligations of US$200,000 to underlying vendors on the Mustang claims. Once Premier has earned its Initial Interest, Premier has a one-time, 60-day option to earn an additional 45% interest (the “Bump-Up Option”) in the Baby Doe project by making a cash payment of US$300,000to Orogen and spending an additional US$5.0 million on exploration expenses. Upon completing the Bump-up option, Premier will make a cash payment of US$500,000 to Orogen and grant a 3%NSR on the Baby Doe claims and a 1% NSR on the Mustang claims. Half of the NSR on the Baby Doe claims can be purchased for US$3.0 million.

If the project receives a decision to proceed with commercial production, Premier will pay US$1.0 million to Orogen and have90-days to make an additional cash payment equal to US$7.50 per gold-equivalent ounce in resources and reserves up to a maximum US$10.0 million.

About the Baby Doe Project

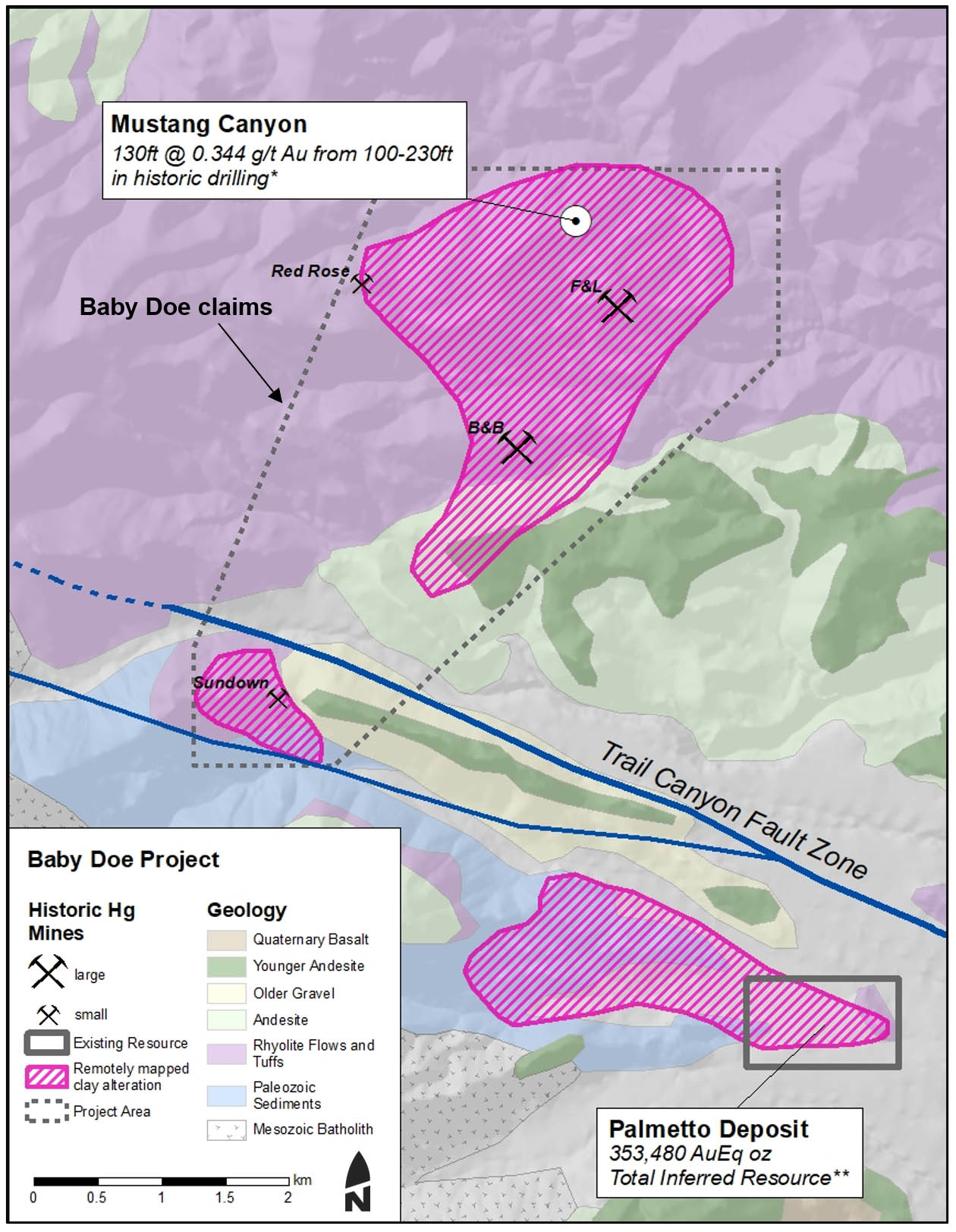

The Baby Doe project is a gold-silver epithermal vein prospect located in the White Mountains, Esmeralda county, Nevada (Figure 1). The project lies within a large, shallow level, steam heated alteration zone containing historic mercury mines. Outcropping drilled gold systems occur to the north and south of the project area, and the most intensely altered portion of the system on the Baby Doe property has seen only limited historic drilling and no known deeper tests of the system (Figure 2). This project was generated as part of a regional generative program focusing on steam-heated alteration zones interpreted to occur above epithermal gold deposits, similar to the Silicon project that is being advanced by AngloGold Ashanti NA, where Orogen holds a 1% NSR.

The Baby Doe project includes 27 unpatented mining claims subject to an Option Agreement dated June 24, 2020 (“Mustang Option”) with Nevada Select Royalty Inc., a subsidiary of Ely Gold Royalties, Inc.(TSX.V:ELY, OTCQX:ELYGF), whereby Orogen has an option to acquire 100% interest in the claims for cash payments total ling US$200,000, and the reservation of a2% NSR.

Qualified Person Statement

Orogen’s disclosure of technical and scientific information in this news release has been reviewed by Robert Felder, Senior Vice President for Orogen. Mr. Felder is a Certified Professional Geologist (#11012) with the American Institute of Professional Geologists and a Qualified Person under the definition of National Instrument 43-101.

About Orogen Royalties

Orogen Royalties Inc. is engaged in project generation for precious and base metal discoveries in western North America with a focus on organic royalty creation and royalty acquisitions. Orogen’s royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR) in Nevada, USA, being developed by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President &CEO at 604-248-8648, and Liliana Wong, Manager of Marketing and Investor Relations at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

moc.seitlayornegoro@ofni

Notes

**Figure 1: TotalInferred Resource: ML Gold Corporation. (2018). Palmetto Resource Estimation and Technical Report (Report No. 171-00767-00-RPT-01_R1) WSP Canada Inc.

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company“) expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward looking information relates to statements concerning the Company’s future outlook and anticipated events or results, as well as the Company’s management expectations with respect to the proposed business combination (the “Transaction”). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company’s business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.